On one hand, there is a backlog of 280,000 tons of inventory, and on the other hand, there is an annual import cost of $3 billion: When will the “sweet trouble” of China’s copper tube industry be resolved?

"Our warehouse is overflowing with standard-sized copper tubes, so we have to temporarily rent third-party storage. But for the ultra-thin-walled precision copper tubes our customers need, we still have to import them from Germany," said Manager Li, head of a copper processing company in Zhejiang. His frustration reflects the common predicament facing China's copper tube industry. As a major producer accounting for over 55% of global copper tube production, China's industry is caught in a structural dilemma of "increased quantity but weak quality": overcapacity in low- and mid-range products has led to high inventory levels, while high-end products have long relied on imports, exceeding $3 billion annually. This seemingly contradictory "sweet trouble" is underpinned by multiple pressures from lagging industrial upgrading, supply-demand mismatch, and intensified global competition. It also tests the resilience of China's copper tube industry in its transformation from "scale expansion" to "quality improvement."

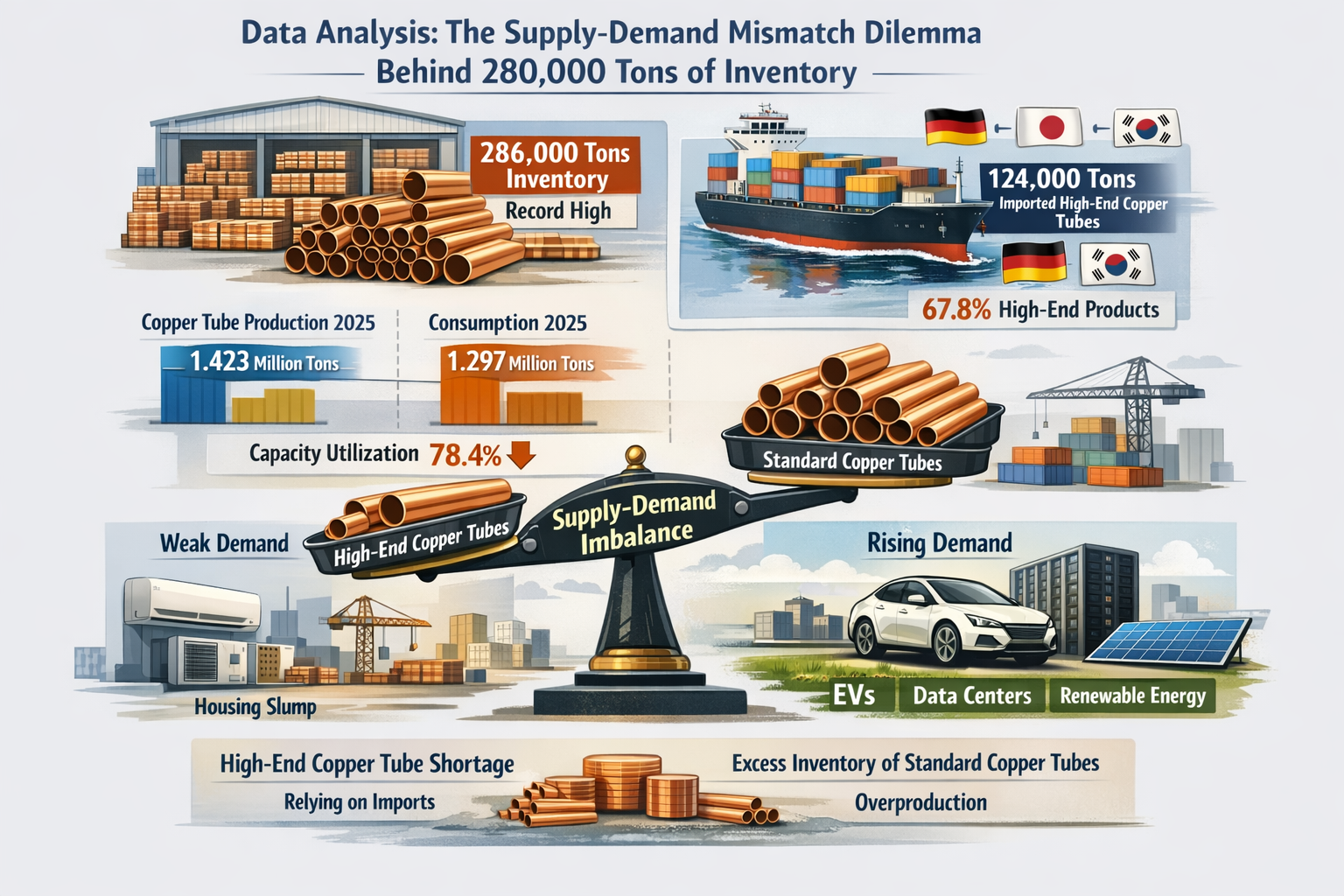

Data Analysis: The Supply-Demand Mismatch Dilemma Behind 280,000 Tons of Inventory

The latest data from the National Bureau of Statistics and the China Nonferrous Metals Industry Association paints a picture of the imbalance in China's copper tube industry. In 2025, the national output of copper tubes reached 1.423 million tons, a year-on-year increase of 6.8%, but the apparent consumption during the same period was only 1.297 million tons, and the capacity utilization rate declined to 78.4%, a decrease of 4.2 percentage points compared with 2024. As of the end of March 2025, the inventory of copper tubes of major copper processing enterprises in China reached 286,000 tons, a new high in nearly five years, with the inventory in East China accounting for as high as 52.3%, highlighting the particularly prominent regional supply and demand mismatch.

In stark contrast to the inventory backlog, China's reliance on imports of high-end copper tube continues to rise. Data from the General Administration of Customs shows that from January to March 2025, China imported 124,000 tons of copper tube, a year-on-year increase of 11.2%, with high-end products accounting for 67.8%, mainly from Germany, Japan, and South Korea. "These imported products are mostly high-end varieties such as ultra-thin-walled copper tube with a wall thickness of ≤0.3mm and ultra-high-purity copper tube for semiconductors; domestic production capacity simply cannot meet the demand," explained Professor Wang, an expert from the China Nonferrous Metals Processing Industry Association. Statistics show that my country needs to import approximately 80,000 tons of precision copper alloy tube annually, with the domestic production rate of ultra-high-purity copper tube for the semiconductor industry less than 10%, and core technologies long monopolized by overseas companies.

The structural divergence in downstream demand has further exacerbated the supply-demand mismatch. The air conditioning and refrigeration industry, the largest consumer of copper tube, accounts for 58.7% of total demand. However, affected by two consecutive years of negative growth in new housing starts, the output of household air conditioners in the first quarter of 2025 increased by only 1.3% year-on-year, leading to near-saturation of demand for conventional copper tube. Meanwhile, emerging fields such as new energy vehicle thermal management systems, data center liquid cooling equipment, and photovoltaic inverter heat dissipation modules are showing rapid growth—new energy vehicle output increased by 34.6% year-on-year in the first quarter of 2025, driving up demand for high thermal conductivity copper tube—but their current market size is insufficient to offset the gap caused by the slowdown in traditional sectors.

|

Product Type |

Domestic production capacity |

Market demand growth |

Import dependence |

|

Standard specification copper tube (Φ6–Φ28mm) |

With a production capacity exceeding 2 million tons, the utilization rate is below 70%. |

1.3%-2.1% |

Less than 5% |

|

Ultra-thin wall copper tube (wall thickness ≤ 0.3mm) |

With a production capacity of only 82,000 tons, there are fewer than 15 companies. |

30% or more |

60% or more |

|

Ultra-high purity copper tubes for semiconductors |

Production capacity is scarce, with only a few companies conducting trial production. |

25% or more |

90% or more |

|

White copper tubes for marine engineering |

Limited production capacity and immature technology |

20% or more |

55% or more |

Table 1: Comparison of Supply, Demand and Import Situation of Different Product Types in China's Copper Tube Industry

In-depth analysis: Three major problems hindering industrial upgrading

The structural predicament of China's copper tube industry is not caused by short-term market fluctuations, but rather by a combination of long-standing industrial path dependence, unbroken technological barriers, and insufficient investment in innovation. In-depth research across the upstream and downstream of the industry reveals that three core problems are hindering the industry's high-quality development.

Problem 1: Low-level repetitive construction and the "wild growth" of low- and mid-end production capacity.

In recent years, to cope with fluctuations in raw material prices and pursue economies of scale, domestic copper processing companies have been expanding their production capacity of low- and mid-range copper tubes. A survey by Shanghai Metals Market (SMM) shows that in 2024, the national new copper tube production capacity was approximately 250,000 tons, with 80% concentrated in central provinces such as Henan, Anhui, and Jiangxi. Most of these production lines utilize traditional extrusion-drawing processes, resulting in severe product homogenization. This low-level, repetitive construction, coupled with volatile copper prices, has further squeezed profit margins for these companies.

"The industry's average gross profit margin was 12.5% in 2022, but it had dropped to 6.8% by the first quarter of 2025," Manager Li admitted. He explained that their company's production of conventional copper tubes for air conditioners yielded a profit of only 200-300 yuan per ton, and some small and medium-sized enterprises were even caught in a vicious cycle of "producing more, losing more." Even more serious is the numerous obstacles to eliminating this excess capacity. Local government tax revenue dependence and sunk costs of equipment investment make capacity clearing extremely difficult.

Problem 2: Lack of core technologies, resulting in severe "bottleneck" in high-end fields.

The production of high-end copper tubes places extremely high demands on material purity control, precision forming processes, and online testing technology. Taking ultra-high purity copper tubes for semiconductors as an example, the oxygen content is typically controlled below 10 ppm. However, most domestic companies are limited by their degassing and impurity removal capabilities in the casting process, resulting in actual product oxygen content generally ranging from 30 to 50 ppm. This makes it difficult to meet the requirements of data center liquid cooling systems or photovoltaic inverter heat dissipation modules for heat transfer efficiency and long-term stability.

In precision forming technology, the gap between domestic enterprises and international advanced levels is equally significant. A German copper processing company uses continuous extrusion and precision rolling technology to control the dimensional accuracy of copper tubes to ±0.005mm, with a surface roughness ≤Ra0.1μm, and a yield rate exceeding 94%. In contrast, over 70% of domestic enterprises still use traditional drawing processes, with a yield rate of only 82.4% and a CNC rate of 31.7%, far below the levels of Germany and Japan. "It's not that we don't want to upgrade our equipment, but an imported precision rolling production line costs tens of millions of yuan and requires professional technical personnel for operation and maintenance, which small and medium-sized enterprises simply cannot afford," said the head of a small copper processing company in Shandong with a sense of helplessness.

Problem 3: The dual pressures of cost and environmental protection leave enterprises with insufficient motivation for transformation.

Raw material costs account for as much as 83.6% of the production cost of copper tubes, while LME copper prices have remained high at $8,650 per ton for an extended period, leaving companies with limited profit margins. Meanwhile, the implementation of new environmental regulations has further exacerbated cost pressures on companies. According to the latest "Emission Standard for Pollutants from Copper and Copper Alloy Processing Industry" (GB 25467-2024), companies need to invest heavily in upgrading environmental protection facilities, with upgrades for a single production line costing between 8 million and 12 million yuan. Furthermore, the expansion of the carbon market has led to a surge in compliance costs, with carbon quota overruns exceeding 5 million yuan per year.

Under cost pressures, enterprises are severely underinvesting in technological research and development. Data shows that the average R&D investment in China's copper processing industry accounts for less than 1.5% of operating revenue, while in developed countries like Germany and Japan, this figure is generally above 3%. This lack of R&D investment makes it difficult for domestic enterprises to break through core technology bottlenecks, forcing them into vicious competition in low-value-added sectors, creating a vicious cycle of "insufficient R&D—technological backwardness—meager profits—inability to conduct R&D."

Breakthrough Path: Technological Innovation and Supply Chain Collaboration as Dual Drivers

Faced with a severe structural predicament, China's copper tube industry urgently needs to break free from path dependence, overcome high-end barriers through technological innovation, optimize resource allocation through supply chain collaboration, and promote the industry's transformation from "scale-driven" to "quality and efficiency-driven." During this critical period of industry transformation, the exploratory practices of some enterprises have provided valuable lessons for the industry's development.

Technological Breakthrough: Targeting High-End Sectors to Achieve Import Substitution

In the production workshop of Guangxi Nanguo Copper Industry, the domestically pioneering "oxygen-enriched side-top blowing smelting + multi-gun top-blowing continuous smelting + pyrometallurgical anode refining" hot-state triple-furnace continuous copper smelting technology is operating efficiently. This technology achieves "one-step copper smelting," which not only has a shorter process flow and stronger raw material adaptability, but also increases the direct metal recovery rate by 3-5 percentage points compared to other processes, significantly improves the utilization rate of mineral heat, and reduces the dust rate to less than 1.8%. Based on this technology, Nanguo Copper Industry has built a circular economy model for the joint smelting of lead, zinc, and copper, with by-product sulfuric acid supplied to manganese and phosphorus enterprises nearby, and solid waste tailings from mineral processing used as raw materials for cement plants, achieving synergistic and comprehensive utilization of resources.

In the field of precision copper tubes, Tianyang Times' breakthroughs are also noteworthy. Targeting the high-end demands of the semiconductor and biopharmaceutical industries, the company's semiconductor UHP tubes utilize VIM+VAR dual metallurgical raw materials, undergoing multiple cold drawing, oxygen-free annealing, and precision electrolytic polishing processes. The inner wall roughness Ra≤0.1μm, and after nitrogen purging in a Class 1000 cleanroom, the particle residue is <10 particles/m², meeting the SEMIC12 high-purity transmission standard. Compared to imported products, Tianyang's UHP tubes reduce costs by 50%, with commonly used specifications delivered quickly within 7-15 days, effectively promoting import substitution for high-end copper tubes.

Supply chain collaboration: Connecting upstream and downstream sectors to enhance overall competitiveness

Supply chain collaboration is key to resolving supply-demand mismatches. On the one hand, upstream copper smelting companies should strengthen cooperation with downstream processing companies to optimize the purity and performance of copper materials based on end-user demand and reduce resource waste in intermediate links. On the other hand, processing companies should deeply connect with downstream application companies to accurately grasp the pain points of demand in emerging fields and carry out customized R&D and production.

In the field of thermal management for new energy vehicles, Hailiang Co., Ltd. has established a joint R&D center with leading domestic new energy vehicle manufacturers. Targeting the thermal management needs of 800V high-voltage platforms, they have jointly developed an ultra-thin-walled microchannel flat tube. This product has a wall thickness of only 0.25mm, improving heat transfer efficiency by 30% and reducing weight by 20%, perfectly meeting the energy-saving requirements of new energy vehicles. Through collaborative R&D across the industry chain, Hailiang Co., Ltd.'s high-end copper tube products have successfully entered the supply chains of leading automakers, and its market share is gradually increasing.

Policy guidance: Optimize industrial layout and strengthen innovation support

Industrial upgrading cannot be achieved without precise policy guidance. Industry experts suggest that the government should introduce targeted policies to curb the blind expansion of low- and mid-end production capacity and encourage enterprises to carry out technological transformation and high-end product research and development. For example, tax incentives and R&D subsidies should be provided for high-end precision copper tube projects, a national-level copper processing technology innovation platform should be established, and collaborative research on core technologies should be promoted. Simultaneously, the recycled copper utilization system should be improved, the proportion of high-quality recycled copper should be increased, raw material costs for enterprises should be reduced, and the green and low-carbon transformation of the industry should be promoted.

Furthermore, in response to the increasing international trade barriers, the government should strengthen cooperation with countries along the Belt and Road Initiative to promote the internationalization of the copper processing industry chain. Enterprises should be encouraged to establish production bases or cooperative parks in emerging markets such as Southeast Asia, utilizing local resources and labor advantages to circumvent trade barriers and expand into overseas high-end markets. According to Yong'an Research, Indonesia, as an emerging refined copper supplier, is expected to increase its refined copper production from 350,000 tons in 2024 to 620,000 tons in 2025, and may reach the million-ton level in 2026, providing new opportunities for the internationalization of Chinese copper tube enterprises.

Say goodbye to "scale worship" and move towards high-quality development

On one hand, there's the heavy burden of 280,000 tons of inventory; on the other, the enormous expenditure of $3 billion in imports. The "sweet dilemma" of China's copper tube industry is essentially the growing pains of transforming its development model. In the global wave of manufacturing transformation towards high-end, intelligent, and green industries, China's copper tube industry must abandon its "scale worship" and prioritize high-quality development.

In the future, only by breaking through high-end barriers through technological innovation, optimizing resource allocation through supply chain collaboration, and enhancing sustainable competitiveness through green transformation can China's copper tube industry truly overcome the supply-demand mismatch and move from a "production giant" to a "manufacturing powerhouse." This transformation may be fraught with challenges, but only by adhering to innovation-driven and collaborative development can China's copper tube industry secure a favorable position in global competition and provide solid material support for the high-quality development of the national economy.

Product Category

Content

- Data Analysis: The Supply-Demand Mismatch Dilemma Behind 280,000 Tons of Inventory

- In-depth analysis: Three major problems hindering industrial upgrading

- Problem 1: Low-level repetitive construction and the "wild growth" of low- and mid-end production capacity.

- Problem 2: Lack of core technologies, resulting in severe "bottleneck" in high-end fields.

- Problem 3: The dual pressures of cost and environmental protection leave enterprises with insufficient motivation for transformation.

- Breakthrough Path: Technological Innovation and Supply Chain Collaboration as Dual Drivers

- Technological Breakthrough: Targeting High-End Sectors to Achieve Import Substitution

- Supply chain collaboration: Connecting upstream and downstream sectors to enhance overall competitiveness

- Policy guidance: Optimize industrial layout and strengthen innovation support

- Say goodbye to "scale worship" and move towards high-quality development

Related news

-

What is a thick-walled copper tube? Thick-walled copper tube, also known as seamless thick-walled copper tube, is a high-performance metal tube made o...

See Details -

Overview and Importance of Copper Capillary Tube In modern industrial equipment and precision control systems, miniaturization and high precision have...

See Details -

What is a copper tube? Analysis of material composition and basic characteristics Definition of copper tube Copper tube is a tubular object made of co...

See Details -

Understanding Copper Square Tubes: Composition, Grades, and Typical Applications Copper square tubes are specialized extrusions that combine the super...

See Details

English

English Español

Español 中文

中文