Investing tens of millions but only using it as an "electronic ledger"? The debate between reality and illusion in the digital transformation of the copper tube industry.

“We spent over 8 million yuan on an ERP system and a production monitoring platform, but in the end, we only moved our paper-based ledgers online. Production efficiency didn't improve much, and it even increased the workload for our employees.” Mr. Wang, the head of a medium-sized copper tube company in Henan Province, expressed the common dilemma faced by the industry in its digital transformation. Driven by the "Made in China 2025" initiative and the Industry 4.0 wave, the copper tube industry has seen a surge in digital transformation efforts, with companies ranging from leading enterprises to small and medium-sized manufacturers investing heavily in intelligent equipment and digital systems. However, the reality is that most companies are trapped in a cycle of "heavy investment, little return," with digitalization remaining superficial; only a few companies have achieved deep empowerment, leveraging digitalization to connect the entire chain of production, supply chain, and customer service, resulting in cost reduction and efficiency improvement. On one hand, there is the formalism of "digitalization for the sake of digitalization," and on the other hand, there is the effective transformation of "driving value creation through digitalization." Why is there such a polarization in the digital transformation of the copper tube industry? Behind this lies a complex interplay of cognitive biases, technological adaptation, talent support, and strategic planning, which also concerns the core driving force for the high-quality development of the industry.

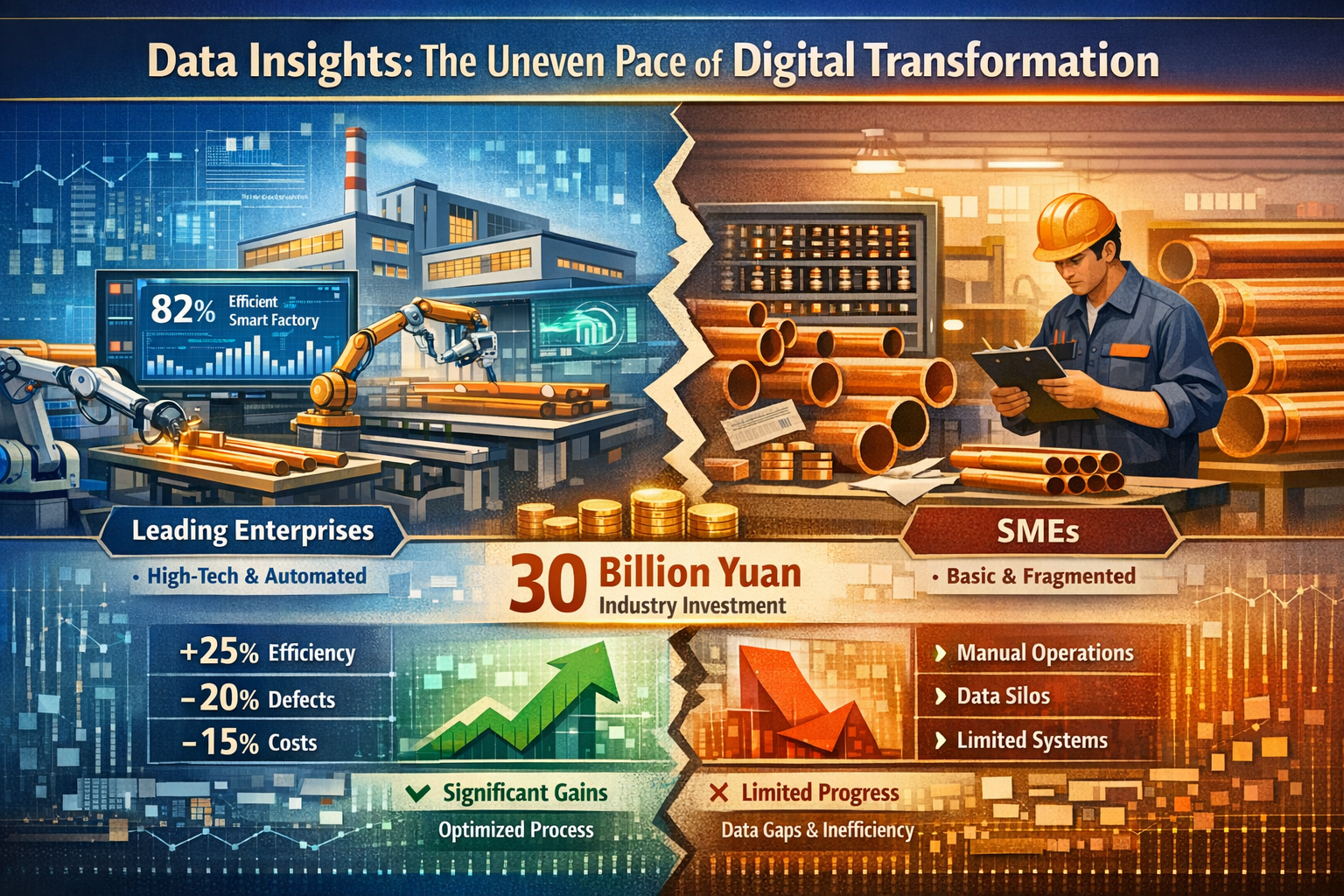

Data Insights: The Uneven Pace of Digital Transformation

According to research data from the China Nonferrous Metals Processing Industry Association, as of the first half of 2025, the digital transformation penetration rate of large-scale copper tube enterprises in China has reached 82%. More than 90% of leading enterprises have completed the digital transformation of their core production processes, and the digital penetration rate of small and medium-sized copper tube enterprises has also reached 75%. In terms of investment scale, leading enterprises invest over 100 million yuan annually in digital transformation, medium-sized enterprises invest between 5 million and 20 million yuan annually, and small enterprises invest mostly between 1 million and 5 million yuan. The cumulative investment in digital transformation across the entire industry exceeds 30 billion yuan.

However, the investment and results have not been proportional, and the digital transformation of the industry shows a clear disparity. Leading companies, with their precise strategic planning and ample resources, have achieved significant results in digital transformation. Through full-process digital management, they have increased production efficiency by an average of 25%-30%, reduced product defect rates by 15%-20%, shortened order delivery cycles by 20%-25%, and lowered overall costs by 10%-15%. In stark contrast, the digital transformation of small and medium-sized manufacturers mostly remains at a basic level. Over 60% of these companies have only achieved online management of aspects such as finance, inventory, and orders, while production processes still rely mainly on manual operation and experience-based judgment. Digital systems have become mere "electronic ledgers," failing to improve efficiency and instead increasing operating costs due to system maintenance and personnel training. Nearly 30% of small and medium-sized enterprises reported that their digital investment was "not worth the cost."

(This image was generated by AI.)

From the perspective of application scenarios, the differences in the depth of digital transformation are equally prominent. Leading companies have achieved full-chain digital collaboration from R&D and design, raw material procurement, production and manufacturing, and quality inspection to warehousing and logistics and customer service. Some companies have even introduced industrial internet platforms and AI algorithms to optimize production processes. However, the digital applications of small and medium-sized enterprises (SMEs) are concentrated in single links, lacking full-chain collaboration, leading to serious data silos. For example, a medium-sized enterprise may have implemented a production monitoring system, but the data cannot be integrated with the inventory management system, and production plan adjustments still require manual statistical verification, making precise scheduling difficult.

| Company Type | Digital investment intensity (as a percentage of revenue) | Core content of the transformation | Key Performance Indicators | Pain points in the transformation process |

| Leading companies (such as Hailiang Co., Ltd.) | 1.5%-2.5% | End-to-end digital collaboration, industrial internet platform development, AI-driven process optimization, and intelligent warehousing and logistics. | Production efficiency +28%, defect rate -18%, delivery time -22%, overall cost -13% | Integrating data across different business units is challenging, and there is a shortage of high-end digital talent. |

| Medium-sized enterprises | 0.8%-1.2% | Basic ERP system, simplified monitoring of production processes, and online management of finances and orders. | Production efficiency increased by 5%-8%, the defect rate did not decrease significantly, and the delivery time decreased by 3%-5%. | Data silos are a serious problem, system compatibility with production scenarios is poor, and operational capabilities are insufficient. |

| Small businesses | 0.3%-0.6% | A simple inventory management system, with some data entry performed manually and no intelligent production equipment. | There was no significant improvement in efficiency; only the record-keeping process was digitized. | Insufficient funding, lack of digital literacy, and a shortage of professional IT maintenance personnel. |

Table 1: Comparison of Digital Transformation Status of Copper Tube Companies of Different Sizes

In-depth analysis: Four fundamental reasons for the divergence between the "virtual" and "real" aspects of digital transformation.

The polarization in the digital transformation of the copper tube industry is not simply due to differences in capital investment, but rather the result of the combined effects of four core factors: cognitive biases, technological suitability, talent support, and strategic planning. In-depth industry research reveals that the transformation difficulties faced by most small and medium-sized enterprises are essentially the inevitable consequence of a transformation logic that prioritizes form over substance.

Root cause one: Cognitive bias, mistakenly equating "online presence" with "digital transformation."

Most small and medium-sized copper tube manufacturers have a serious misunderstanding of digital transformation, simply equating it to "going online" or "electronization." They believe that implementing an ERP system and transferring paper-based records online constitutes completing digital transformation. This understanding overlooks the core value of digitalization—optimizing production, supply chain, and customer service through data-driven insights, thereby achieving overall efficiency improvements and value creation across the entire chain.

“When we initially implemented the ERP system, we did so because we saw our competitors doing it, and we felt we would fall behind if we didn't. But after going live, we realized that the system only recorded data but couldn't use that data to guide production. For example, the system could count the number of defective products during production, but it couldn't analyze whether the problem was due to raw materials, equipment parameters, or operational issues; we still had to rely on the experience of our veteran workers to make judgments.” Mr. Wang admitted that this kind of “passive imitation” of digital transformation not only failed to create value but also increased employees' operational costs. In contrast, leading companies consistently prioritize “data-driven decision-making,” integrating digitalization throughout all aspects of production, supply chain, and R&D, using data mining to optimize processes and precisely allocate resources.

Root cause two: Technological mismatch; "general-purpose systems" are difficult to adapt to "specific scenarios."

The production of copper tubes is characterized by complex processes, numerous variable parameters, and prominent individualized requirements. The production processes and quality standards of different types of copper tubes vary significantly, demanding a high degree of adaptability from digital systems. However, most digital systems currently on the market are general-purpose products, lacking customized designs for the specific scenarios of the copper tube industry. This leads to a disconnect between the systems and the actual production scenarios of enterprises.

For example, conventional ERP systems focus on finance and order management and cannot accurately adapt to the parameter monitoring and optimization of core processes such as melting, drawing, and annealing in copper tube production. Some companies have introduced intelligent production equipment, but due to a lack of compatibility design with existing production lines, these systems can only operate independently, preventing data exchange and collaborative scheduling. Leading companies, however, often adopt a "general system + customized development" model, combining their own production characteristics and product requirements to conduct secondary development of digital systems, ensuring deep integration of the system with the production environment. For instance, Hailiang Co., Ltd. collaborated with a technology company to customize and develop a copper processing industrial internet platform. This platform, specifically designed for the core processes of copper tube production, establishes a dedicated data model that can collect real-time data on equipment parameters, raw material composition, and environmental temperature. Through algorithmic optimization of process parameters, it improves product quality and production efficiency.

Root cause three: Talent shortage, leading to a lack of core support for "transformation implementation."

The successful implementation of digital transformation depends on multidisciplinary talents who understand both copper tube manufacturing processes and digital technologies. However, the current talent structure in the copper tube industry is imbalanced, with a large number of traditional skilled workers and a severe shortage of digital talents, which has become a core bottleneck limiting the depth of the transformation.

Leading companies, with their strong financial resources and comprehensive incentive mechanisms, are able to attract high-end digital talent and build professional digital teams responsible for system development, operation and maintenance, data mining, and optimization. Small and medium-sized enterprises (SMEs), however, struggle to afford the salaries of high-end digital talent and lack a digital training system for their internal employees. This often results in digital transformation efforts being handled by administrative and financial personnel as a secondary responsibility, preventing the deep integration of digital technologies into production processes. "After our system went live, nobody knew how to perform data analysis; they could only view simple reports, and the core functions of the system were completely unused," said the head of a small copper tube company. This talent shortage leaves the digital system in a state of disuse, making a successful transformation naturally difficult.

Root cause four: Lack of strategy, making "fragmented transformation" difficult to form a coherent system.

Digital transformation is a systemic undertaking that requires integrated planning and phased implementation in conjunction with the company's development strategy. However, most small and medium-sized copper tube manufacturers lack a clear digital transformation strategy, often resorting to "fragmented investments," tackling issues haphazardly without clear transformation goals or a comprehensive implementation roadmap. This results in disorganized transformation efforts and a lack of synergistic effects.

Some companies first implement financial systems, then production monitoring systems, and finally warehouse management systems. These systems come from different vendors, resulting in incompatible data interfaces and creating data silos. Other companies blindly purchase smart equipment without a corresponding digital management system, preventing the equipment from being fully utilized. In contrast, leading companies develop clear strategic plans at the beginning of their transformation, defining short-term, medium-term, and long-term transformation goals. They take a holistic, end-to-end approach to digital transformation, ensuring that all aspects of the transformation are coordinated and integrated, creating a digital ecosystem with data interoperability and business linkages.

Breaking the Stalemate: Four Paths from "Formal Transformation" to "Value Empowerment"

To overcome the "theoretical vs. practical" debate in the digital transformation of the copper tube industry, the key lies in abandoning formalism, focusing on value creation, and choosing a suitable transformation path based on the company's size and development needs, thereby achieving deep integration of digitalization with production and operations. The successful practices of leading companies and the advice of industry experts provide valuable guidance for companies of different sizes.

Path 1: Establish the correct understanding and clarify the core objectives of the transformation.

Businesses need to break through misconceptions about digital transformation and clarify that the core of digitalization is "data-driven value creation," not simply going online. Businesses of different sizes should set clear transformation goals based on their specific circumstances: leading companies can focus on full-chain digital collaboration and intelligent upgrades to create industry benchmarks; medium-sized enterprises can prioritize digital control of core production processes to address pain points such as production efficiency and product quality; and small businesses can start with basic digital inventory management and data record-keeping, gradually accumulating transformation experience and data resources.

At the same time, companies should strengthen internal communication and training to enhance employees' understanding of digitalization, allowing them to understand the value of digital transformation for both the company and themselves, and actively participate in the transformation process. For example, Hailiang Co., Ltd. regularly organizes digital transformation training, inviting industry experts and technical personnel to give lectures, covering all positions from management to frontline workers, creating an atmosphere where "everyone understands and uses digitalization."

Path 2: Accurately adapt to different scenarios and select differentiated technical solutions.

Enterprises should select suitable digital technologies and solutions based on their production processes, product characteristics, and business needs, avoiding the blind purchase of generic systems. Leading companies can leverage their financial and technological advantages to build customized industrial internet platforms, introducing technologies such as AI and big data to optimize process parameters and achieve intelligent scheduling; medium-sized enterprises can choose modular digital systems, prioritizing the integration of data across core functions such as production, inventory, and orders to achieve basic collaboration; and small enterprises can adopt lightweight, low-cost SaaS services to meet their daily operational and management digital needs.

During the implementation of technology, enterprises should focus on the compatibility between the system and the production scenario, and conduct secondary development when necessary. For example, a medium-sized copper tube company in Anhui customized a general ERP system to meet its specific needs for precision copper tube production. They added modules for process parameter monitoring and quality traceability, and integrated it with intelligent testing equipment to achieve real-time data collection and analysis of the production process. This resulted in a 12% increase in production efficiency and an 8% decrease in product defect rate.

Path 3: Build a talent system and strengthen the capabilities supporting the transformation.

Talent is the core support for digital transformation, and companies need to build a diversified talent system encompassing "recruitment + training + outsourcing." Leading companies can recruit high-end digital talent and assemble professional teams responsible for system development, data mining, and optimization; medium-sized enterprises can cultivate internal key personnel through training and job rotation to improve employees' digital skills, while outsourcing some technical maintenance work; small businesses can rely on third-party service providers to address the operation and technical support issues of digital systems, thereby reducing talent costs.

Furthermore, companies should strengthen cooperation with universities and vocational colleges to cultivate interdisciplinary talents who understand both copper tube production and digital technologies. For example, Hailiang Co., Ltd. has established cooperative relationships with Zhejiang University of Technology and vocational colleges, setting up specialized classes in "digital copper processing." These classes are designed with curricula tailored to the company's needs, cultivating professional talents and providing continuous talent support for digital transformation.

Path 4: Develop a strategic plan and promote collaborative implementation step by step.

Digital transformation is not a one-time event; companies need to develop long-term strategic plans and implement them in phases. The first step involves streamlining business processes, identifying transformation pain points and core needs, and building a digital infrastructure to digitize core business processes. The second step involves integrating data interfaces across various systems, eliminating data silos, and enabling business collaboration and data-driven decision-making. The third step involves introducing intelligent technologies and equipment to optimize production processes, supply chain management, and customer service, achieving intelligent upgrades across the entire value chain.

At the same time, companies should establish a digital transformation evaluation mechanism, linking transformation results to departmental and employee performance to ensure that transformation efforts are implemented effectively. For example, a leading company incorporated core digital transformation indicators such as production efficiency, defect rate, and delivery cycle into the performance evaluation system of each production workshop and department, thereby incentivizing all departments to actively promote digital transformation, resulting in significant improvements.

With "practical results" at its core, we are restructuring the logic of digital transformation.

Investing tens of millions yet only using it as an "electronic ledger," the debate between the "reality and illusion" of digital transformation in the copper tube industry essentially stems from a flawed transformation logic. In the wave of digital transformation in the manufacturing industry, copper tube companies must abandon formalism and focus on "value empowerment," combining their own scale and needs to choose a suitable transformation path. Only then can digitalization truly become a powerful engine for reducing costs, increasing efficiency, and enhancing core competitiveness.

In the future, with the continuous maturation of technologies such as industrial internet, AI, and big data, and the improvement of digital awareness within the industry, the digital transformation of the copper tube industry will gradually move from a "fragmented" approach to a "systematic" one, and from a "formalistic" approach to a "results-oriented" one. Leading enterprises will continue to drive intelligent upgrades, small and medium-sized manufacturers will achieve precise transformation through differentiated paths, and the entire industry will form a new pattern of "collaboration among large, medium, and small enterprises, and deep integration of digitalization and industry," injecting new momentum into the high-quality development of China's copper tube industry.

Product Category

Content

- Data Insights: The Uneven Pace of Digital Transformation

- In-depth analysis: Four fundamental reasons for the divergence between the "virtual" and "real" aspects of digital transformation.

- Root cause one: Cognitive bias, mistakenly equating "online presence" with "digital transformation."

- Root cause two: Technological mismatch; "general-purpose systems" are difficult to adapt to "specific scenarios."

- Root cause three: Talent shortage, leading to a lack of core support for "transformation implementation."

- Root cause four: Lack of strategy, making "fragmented transformation" difficult to form a coherent system.

- Breaking the Stalemate: Four Paths from "Formal Transformation" to "Value Empowerment"

- Path 1: Establish the correct understanding and clarify the core objectives of the transformation.

- Path 2: Accurately adapt to different scenarios and select differentiated technical solutions.

- Path 3: Build a talent system and strengthen the capabilities supporting the transformation.

- Path 4: Develop a strategic plan and promote collaborative implementation step by step.

- With "practical results" at its core, we are restructuring the logic of digital transformation.

Related news

-

What is a thick-walled copper tube? Thick-walled copper tube, also known as seamless thick-walled copper tube, is a high-performance metal tube made o...

See Details -

Overview and Importance of Copper Capillary Tube In modern industrial equipment and precision control systems, miniaturization and high precision have...

See Details -

What is a copper tube? Analysis of material composition and basic characteristics Definition of copper tube Copper tube is a tubular object made of co...

See Details -

Understanding Copper Square Tubes: Composition, Grades, and Typical Applications Copper square tubes are specialized extrusions that combine the super...

See Details

English

English Español

Español 中文

中文