A 0.01% difference in purity can lead to millions of dollars in lost orders: The "invisible hurdle" in controlling copper tube raw materials.

“Both are T2 copper tubes, but the ones we produce using 99.98% pure electrolytic copper raw materials frequently exhibit uneven heat dissipation in new energy vehicle motor cooling applications; while our competitors' products, made with 99.99% pure raw materials, consistently secure multi-million dollar orders from automotive manufacturers.” Mr. Chen, the purchasing director of a copper tube company in Wuxi, revealed a hidden pain point in the industry while holding two raw material testing reports. Raw material purity, as the starting point of copper tube production, seems to be only a difference of a few decimal places, but it directly determines the core performance of the product, such as thermal conductivity, electrical conductivity, and toughness, and even becomes the "pass" for companies to enter the high-end market. Currently, most domestic copper tube manufacturers, in order to control costs, use ordinary purity raw materials, only meeting the needs of conventional applications; a few high-end manufacturers, however, implement extreme control over raw material purity, even precisely controlling trace impurity components, seizing the high-end supply chain with this upstream advantage. This 0.01% difference in purity not only differentiates product levels but also holds the key to the copper tube industry's transformation from "qualified" to "high-end."

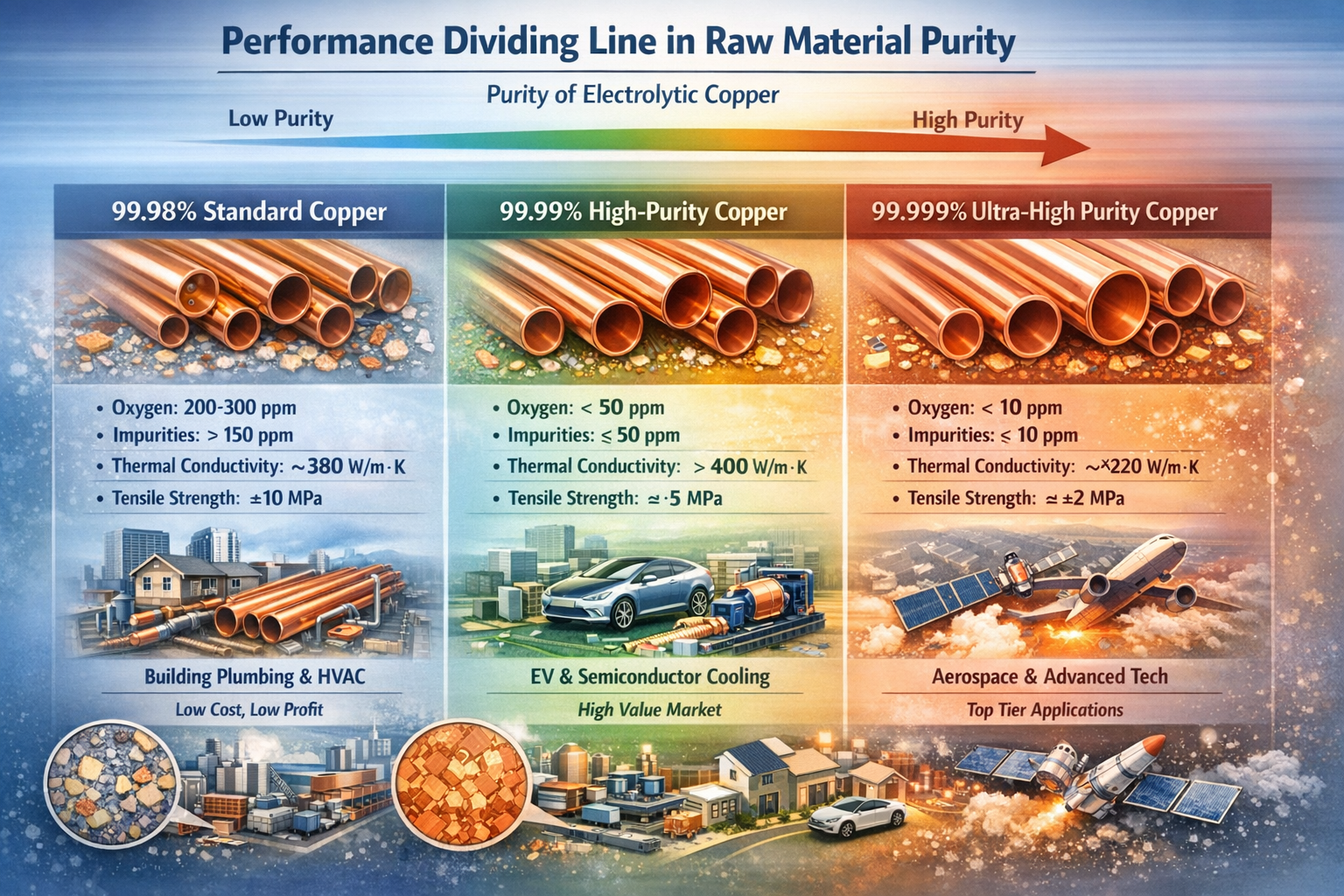

Detailed Analysis: The "Performance Dividing Line" in Raw Material Purity

The core component of copper tube raw materials is electrolytic copper. The purity and the content of trace impurities (such as oxygen, iron, lead, and zinc) directly affect the metal's microstructure, which in turn determines the performance of the final product. According to testing data from the China Nonferrous Metals Processing Industry Association: ordinary electrolytic copper with a purity of 99.98% has an oxygen content of approximately 200-300 ppm and a total impurity content of over 150 ppm. When processed into copper tubes, its thermal conductivity is approximately 380 W/(m·K), and its tensile strength fluctuates by ±10 MPa, making it prone to performance degradation in high-temperature and high-frequency applications. High-purity electrolytic copper with a purity of 99.99% has an oxygen content controllable to below 50 ppm and a total impurity content of ≤50 ppm. After processing, the thermal conductivity of the copper tube increases to over 400 W/(m·K), and the tensile strength fluctuation is ≤±5 MPa, resulting in significantly improved performance stability. For demanding applications such as aerospace and semiconductors, companies use ultra-high-purity copper raw materials with a purity of 99.999%, a total impurity content of ≤10 ppm, and a thermal conductivity of up to 420 W/(m·K), perfectly suited for extreme operating conditions.

From the perspective of application scenarios and order value, the difference in raw material purity directly determines a company's market influence. For ordinary building plumbing and household air conditioning copper tubes, the requirements for raw material purity are relatively low; 99.97%-99.98% purity is sufficient. The profit per ton for these products is only 2000-3000 yuan. However, high-end applications such as thermal management in new energy vehicles, semiconductor equipment cooling, and aerospace wiring have stringent requirements for raw material purity and impurity content, requiring high-purity raw materials of 99.99% or higher. The profit per ton for these products can reach 8000-15000 yuan, and the orders are more stable. A new energy vehicle manufacturer's procurement standards explicitly stipulate that the raw material purity for motor cooling copper tubes must be ≥99.99%, with oxygen content ≤80ppm and iron content ≤10ppm. Only about a dozen companies in China can strictly control raw material purity to meet these standards, and most small and medium-sized enterprises are excluded from the high-end market due to the raw material requirements.

(This image was generated by AI.)

From a business cost and revenue perspective, while increasing raw material purity will increase procurement costs, it can significantly reduce subsequent production and after-sales costs. Ordinary raw materials, due to their high impurity content, are prone to problems such as cracking and slag inclusion during processing, resulting in a product defect rate of approximately 5%-8%, and requiring additional purification and screening processes. High-purity raw materials have low impurity content and good processing compatibility, reducing the defect rate to below 1%. Although the procurement cost per ton is 5000-8000 yuan higher, the overall production cost is lower, and the product's premium pricing potential far exceeds the increased raw material costs, leading to more substantial long-term profits.

| Raw Material Purity Level | Core Impurity Content (ppm) | Copper Tube Performance After Processing | Applicable Scenarios | Raw Material Procurement Cost (RMB/ton) | Product Profit per Ton (RMB) | Product Defect Rate |

| Ordinary Purity (99.97%-99.98%) | Oxygen 200-300, Iron 50-80, Lead 30-50, Total Impurities ≥150 | Thermal conductivity 370-380 W/(m·K), Tensile strength fluctuation ±10 MPa | Ordinary building water supply and drainage, household air conditioning copper tubes | 62000-65000 | 2000-3000 | 5%-8% |

| High Purity (99.99%) | Oxygen ≤80, Iron ≤15, Lead ≤10, Total Impurities ≤50 | Thermal conductivity 400-410 W/(m·K), Tensile strength fluctuation ±5 MPa | New energy vehicle thermal management, mid-range industrial equipment | 68000-73000 | 8000-12000 | 1%-2% |

| Ultra-High Purity (99.999%) | Oxygen ≤20, Iron ≤5, Lead ≤3, Total Impurities ≤10 | Thermal conductivity 415-420 W/(m·K), Tensile strength fluctuation ±3 MPa | Aerospace, semiconductor equipment, high-end medical equipment | 85000-95000 | 12000-15000 | ≤0.5% |

Table 1: Comparison of Core Parameters and Application Value of Copper Tube Raw Materials with Different Purity Levels

Detailed breakdown: The three core issues behind the differences in raw material purity control

The seemingly small difference of just 0.01% in purity actually reflects a significant gap in capabilities across three core areas: raw material procurement, testing and quality control, and impurity management. In-depth research into companies reveals that the disparity in raw material purity control among domestic enterprises is not simply a matter of "whether they can afford high-purity raw materials," but rather a difference in their ability to manage and optimize the entire process of raw material quality control. These three key issues collectively lead to the differentiation in product performance and market positioning.

Problem 1: Short-sighted procurement strategies prioritize cost over quality

Most small and medium-sized copper tube manufacturers, constrained by limited capital and short-term profit demands, adopt a "cost-first" procurement strategy, prioritizing low-priced, standard-purity raw materials. To further reduce costs, some even purchase substandard raw materials that are adulterated or contain excessive impurities. These companies lack a long-term strategic vision, neglecting the impact of raw material purity on product performance, defect rates, and brand reputation. While this may reduce procurement costs in the short term, it leads to substandard product performance, high defect rates, missed opportunities for high-end orders, and increased after-sales service costs, trapping them in a vicious cycle of "low price, low quality."

In contrast, high-end companies have established "quality-first" procurement systems, signing long-term strategic cooperation agreements with large domestic electrolytic copper enterprises (such as Jiangxi Copper and Aluminum Corporation of China) or importing high-purity copper suppliers. These agreements clearly define core indicators such as raw material purity and impurity content, and some companies even assign dedicated personnel to supervise production at the supplier's factory to ensure stable raw material quality. Some companies also customize their raw material procurement based on downstream application requirements, for example, specifically purchasing low-oxygen, high-purity copper raw materials for semiconductor applications, thus ensuring product suitability from the source.

Problem 2: Weak testing capabilities make it difficult to accurately control raw material quality

Accurate testing of raw material purity and impurity content is a core aspect of quality control. However, most small and medium-sized enterprises in China lack professional testing equipment and technical teams, making it difficult to accurately identify raw material quality. Ordinary companies often use traditional chemical titration methods to test copper purity, which can have an error of up to ±0.02%, and cannot detect trace impurities, easily leading to substandard raw materials entering the production line. High-end companies, on the other hand, are equipped with sophisticated testing equipment such as inductively coupled plasma mass spectrometers (ICP-MS) and infrared carbon-sulfur analyzers, achieving a testing accuracy of 0.001%. This allows for the precise determination of various trace impurities such as oxygen, iron, and lead. Furthermore, each batch of raw materials undergoes sampling and testing before being accepted into inventory, and any substandard materials are returned, eliminating potential quality risks.

More importantly, high-end companies have established a complete raw material traceability system, linking testing data with raw material batches and supplier information. If problems arise during subsequent production, they can quickly trace the issue back to the raw material stage and pinpoint the cause. However, small and medium-sized enterprises lack this traceability capability, making it difficult to identify responsibility when raw material quality issues occur, forcing them to bear all the losses. "We once had a batch of raw materials with excessive iron content that caused product cracking. It took us half a month to trace the problem back to the raw materials, resulting in losses of nearly one million yuan. With an accurate testing and traceability system, we could have avoided such problems," Manager Chen admitted.

Problem 3: Lack of impurity control prevents the materials from meeting the requirements of high-end applications

High-end applications demand exceptional performance from copper tubes, requiring not only high-purity raw materials but also precise control of trace impurity components. Optimizing these impurities enhances specific product performance. For example, adding trace amounts of phosphorus (50-100 ppm) to the copper raw material reduces oxygen content, improving the welding performance and corrosion resistance of the copper tubes; adding trace amounts of silver (200-300 ppm) improves thermal conductivity and strength, making them suitable for aerospace applications. However, most domestic companies lack the technology for impurity control and can only rely on standard products provided by raw material manufacturers, making it difficult to optimize impurity composition according to downstream needs and meet the personalized requirements of high-end applications.

High-end companies have mastered trace impurity control technology through independent research and development and collaborative partnerships. Some companies have established dedicated raw material processing workshops to further refine purchased high-purity raw materials, precisely adding specific trace elements to optimize product performance. Simultaneously, they collaborate with universities and research institutions to study the relationship between impurity composition and product performance, building a database of impurity control information. This allows them to develop customized raw material formulations for different applications, creating a differentiated competitive advantage.

Breaking the Stalemate: The Path to Raw Material Upgrading – From "Passive Procurement" to "Proactive Control"

Controlling the purity of raw materials is the key to copper tube companies breaking into the high-end market. For domestic companies, it's not necessary to blindly pursue ultra-high purity raw materials. Instead, they can gradually achieve precise control over raw material quality by optimizing procurement strategies, strengthening testing capabilities, and mastering impurity control technologies, thereby enhancing product competitiveness from the source.

Path 1: Optimize procurement strategies and establish a quality-oriented supply chain system

Companies should abandon the short-sighted "cost-first" mentality and select raw materials with appropriate purity based on product positioning. Small and medium-sized enterprises can focus on the mid-range market, using raw materials with a purity of 99.985%-99.99% to balance quality and cost; high-end companies can specifically procure high-purity and ultra-high-purity raw materials, while establishing long-term cooperation with high-quality suppliers, signing quality assurance agreements, and clearly defining testing standards and liability for breach of contract. In addition, companies can establish a supplier grading system to evaluate suppliers' production capacity, testing capabilities, and quality stability, prioritizing suppliers with high-purity raw material production capabilities and advanced testing equipment to reduce quality risks at the source.

The transformation practices of a medium-sized copper tube company in Changzhou are highly instructive. This company abandoned low-priced, ordinary raw materials and chose to cooperate with Jiangxi Copper to purchase 99.99% pure raw materials. Although the procurement cost increased by 6,000 yuan per ton, the product defect rate decreased from 7% to 1.8%, eliminating the need for additional purification processes. This resulted in an overall cost reduction of 3,000 yuan per ton. Simultaneously, the company successfully entered the mid-range new energy vehicle supply market, increasing its profit per ton to 6,000 yuan and achieving a return on investment of over 50%.

Path 2: Strengthen testing capabilities and build a comprehensive quality control system throughout the entire process

Companies should equip themselves with suitable testing equipment and professional teams based on their specific needs. Small and medium-sized enterprises can introduce cost-effective atomic absorption spectrophotometers, which offer a detection accuracy of 0.005%, meeting the needs of mid-range raw material testing. High-end companies require sophisticated testing equipment such as ICP-MS to achieve precise measurement of trace impurities. Simultaneously, a comprehensive testing mechanism should be established, encompassing raw material incoming inspection, in-process sampling, and finished product re-inspection, with clear testing standards defined for each stage to ensure that raw material quality and product performance meet the required standards.

Furthermore, companies should establish a raw material traceability system, linking raw material batches, supplier information, testing data, and production process data to achieve full traceability and facilitate rapid identification of quality problems. At the same time, they should strengthen the training of testing personnel to improve their professional skills and ensure the accuracy and reliability of testing data. One company, by establishing a comprehensive testing and traceability system, reduced the incidence of raw material quality problems from 3% to 0.3%, significantly improving its brand reputation and increasing the proportion of high-end orders from 20% to 45%.

Path 3: Implement impurity control measures to create a differentiated competitive advantage

Companies with the necessary resources can gradually implement impurity control technologies to enhance their ability to customize products. On the one hand, they can establish R&D teams to study the relationship between trace impurity components and product performance, and attempt to optimize product performance by adding specific trace elements. On the other hand, they can collaborate with universities and research institutions, leveraging external technical expertise to conduct impurity control research and develop proprietary process formulations. For companies that currently lack independent R&D capabilities, they can collaborate with raw material suppliers to customize and develop raw materials tailored to specific applications, meeting the needs of high-end customers.

For example, a high-end copper tube company collaborated with Central South University to develop a "trace silver-doped high-purity copper" raw material formula. By adding 250 ppm of trace silver to 99.99% high-purity copper, the thermal conductivity of the copper tubes increased by 5%, and the tensile strength increased by 8%. This successfully adapted the product for aerospace wire applications, resulting in a product premium of 40%, far exceeding the industry average.

Controlling quality at the source, the purity of raw materials underpins high-end competitiveness

A difference in purity of just 0.01% can mean the difference between millions of dollars in orders and different levels of market positioning. This seemingly minor detail reflects the core logic behind the transformation of China's copper tube industry from "scale expansion" to "quality improvement"—the competition in high-end manufacturing begins with controlling raw materials at the source. The subtle differences in raw material purity, amplified through the production process, ultimately create a huge disparity in product competitiveness, becoming an invisible barrier for companies entering the high-end market.

For Chinese copper tube manufacturers, it's not necessary to solely pursue technological breakthroughs in the production process. By focusing on the fundamental detail of raw material purity, optimizing procurement strategies, strengthening testing capabilities, and implementing impurity control measures, they can improve product performance stability and added value through precise source control, thus breaking through the barriers of the high-end market. Only when more companies begin to prioritize the refined management of raw material quality can the Chinese copper tube industry truly escape the trap of low-end competition, transform from a "major manufacturing country" to a "manufacturing powerhouse," and occupy a core position in the global high-end supply chain.

Product Category

Content

- Detailed Analysis: The "Performance Dividing Line" in Raw Material Purity

- Detailed breakdown: The three core issues behind the differences in raw material purity control

- Breaking the Stalemate: The Path to Raw Material Upgrading – From "Passive Procurement" to "Proactive Control"

- Path 1: Optimize procurement strategies and establish a quality-oriented supply chain system

- Path 2: Strengthen testing capabilities and build a comprehensive quality control system throughout the entire process

- Path 3: Implement impurity control measures to create a differentiated competitive advantage

- Controlling quality at the source, the purity of raw materials underpins high-end competitiveness

Related news

-

What is a thick-walled copper tube? Thick-walled copper tube, also known as seamless thick-walled copper tube, is a high-performance metal tube made o...

See Details -

Overview and Importance of Copper Capillary Tube In modern industrial equipment and precision control systems, miniaturization and high precision have...

See Details -

What is a copper tube? Analysis of material composition and basic characteristics Definition of copper tube Copper tube is a tubular object made of co...

See Details -

Understanding Copper Square Tubes: Composition, Grades, and Typical Applications Copper square tubes are specialized extrusions that combine the super...

See Details

English

English Español

Español 中文

中文