Silver-Copper Tubes: A High-End Breakout in a Niche Market—Can This Segment Become a New Profit Engine for the Copper Tube Industry?

Subtitle: While ordinary copper tubes are trapped in price wars, silver-copper tubes achieve counter-trend growth with high value-added applications in medical gases and semiconductors—how can this segment, accounting for less than 5% of total industry capacity, achieve gross margins exceeding 30%?

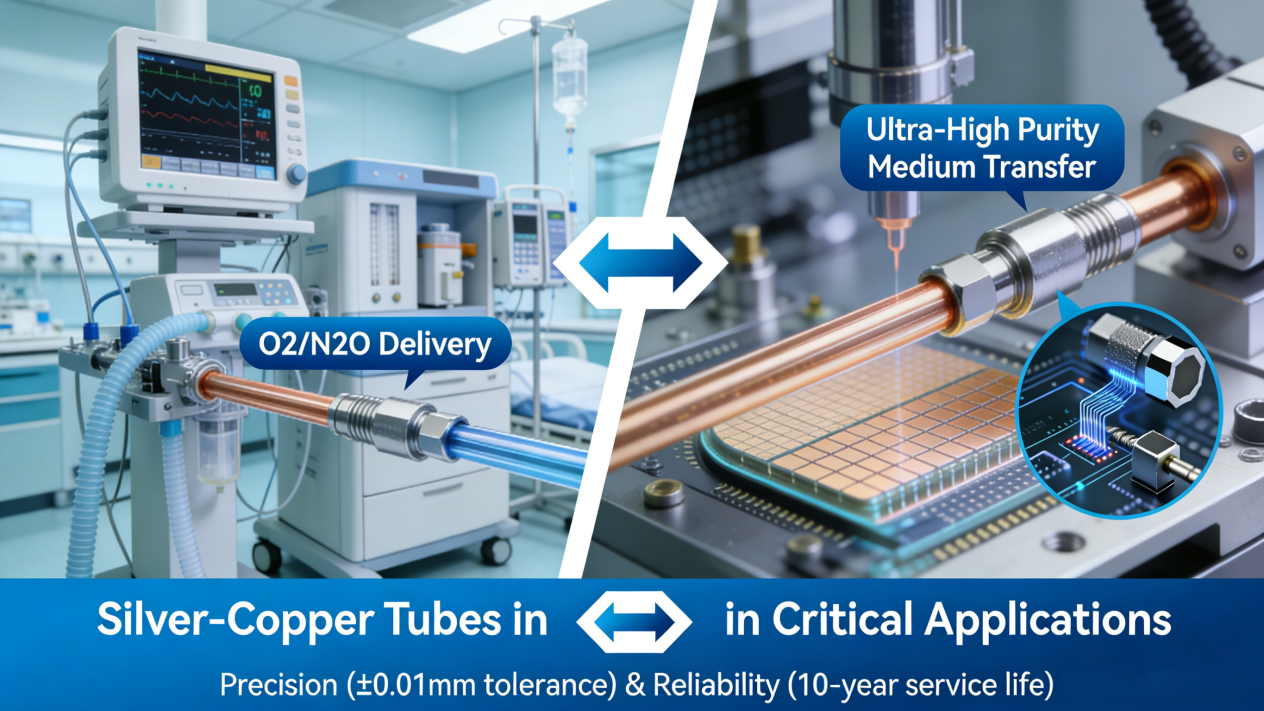

Demand Differentiation: High-End Applications Driving Growth in a Niche Market

In 2025, silver-copper tubes (including silver-copper alloy tubes) account for less than 5% of the global copper tube market but contribute over 15% of its profits . Unlike ordinary copper tubes, which are primarily used in construction and air conditioning, silver-copper tubes serve high-end sectors such as medical gas transmission, semiconductor equipment, and aerospace pipelines . Their prices are 3–5 times higher than ordinary copper tubes, with gross margins reaching 25%–30%.

This demand surge stems from technological advancements. In the medical field, the antibacterial properties of silver ions make silver-copper tubes the preferred choice for hospital gas supply systems, with a penetration rate of 60% in new hospital projects in Europe and North America . The semiconductor sector requires ultra-high-purity copper tubes (oxygen content ≤5 ppm) with exceptional resistance to bending fatigue. The addition of silver significantly enhances tube lifespan and stability, making these tubes critical for high-precision applications.

Table: Application Scenarios and Profit Comparison of Silver-Copper Tubes vs. Ordinary Copper Tubes (2025)

|

Indicator |

Ordinary Copper Tubes (AC/Construction) |

Silver-Copper Tubes (High-End Fields) |

Difference Multiple |

|

Price Range |

$7,000–9,000/ton |

$20,000–40,000/ton |

3–5x |

|

Gross Margin |

3%–5% |

25%–30% |

6–8x |

|

Technical Barrier |

Low (standardized production) |

High (purity/precision control) |

Vastly different entry thresholds |

|

Demand Growth Rate |

2%–3% annually |

12%–15% annually |

~5x difference |

Technical Barriers: The Process Revolution Behind 0.1% Silver Content

The core competitiveness of silver-copper tubes lies in material formulation and process control. Jiangxi Nailuo Copper Industry’s B10 nickel-silver alloy tube, by adding 10% nickel and 1.5% silver, improves corrosion resistance in seawater by 50% and extends service life to over 30 years, making it a key material for shipbuilding and marine engineering.

Purity control is another critical differentiator. Semiconductor-grade silver-copper tubes require copper purity ≥99.99%, with silver content fluctuations controlled within ±0.01% . Germany’s Wieland Group uses vacuum melting + vertical continuous casting technology to reduce internal impurities to below 0.001%, enabling product prices 8 times higher than ordinary copper tubes . Domestic Chinese companies, such as those in Yingtan, have broken foreign technological monopolies by developing methods like the "ultra-low oxygen split horizontal continuous casting process," reducing the cost of high-end silver-copper tubes by 40%.

Regional Landscape: Europe Dominates the High End, China Breaks into Segments

The global silver-copper tube market exhibits a clear technological gradient :

Europe: Dominates the highest-end segments like medical and semiconductors. Germany’s Wieland and KME Group hold 60% of the global high-purity silver-copper tube market.

North America: Focuses on aerospace and defense. U.S.-based Materion produces silver-copper alloy tubes for rocket engine cooling systems.

China: Excels in niche markets like marine-grade B10 nickel-silver tubes and new energy battery materials. Yingtan-based companies account for 25% of the global market share for marine-grade silver-copper tubes .

The rise of Chinese companies benefits from industrial chain collaboration. Yingtan City’s "copper-based new materials cluster" integrates upstream smelting, midstream processing, and downstream applications, reducing R&D cycles by 30% and costs by 20% .

Future Trends: New Material Revolution and Substitution Challenges

Silver-copper tubes face dual challenges from new materials and process innovations . In the medical field, antibacterial-coated stainless steel tubes can achieve similar antibacterial effects at a 30% lower cost. In semiconductors, aluminum silicon carbide composites show better thermal conductivity in some scenarios.

However, silver-copper tubes remain irreplaceable in terms of reliability. For medical gas transmission, their total lifecycle cost is lower—30 years without replacement, whereas alternative materials may require mid-term maintenance. In high-temperature semiconductor environments, the creep resistance of silver-copper tubes is twice that of most new materials.

The Survival Strategy of a Niche Market

The competition logic of silver-copper tubes is fundamentally different from that of ordinary copper tubes: scale effects are being replaced by technical barriers as the primary competitive factor, and price sensitivity is giving way to reliability prioritization . Over the next five years, as high-end demand from medical, semiconductor, and new energy sectors continues to grow, the silver-copper tube market is expected to maintain an annual growth rate of over 10%, becoming a rare "profit blue ocean" in the copper tube industry .

For companies, the key to breaking through lies in focusing on specific segments, binding high-end customers, and continuous process innovation. As the chief engineer of Jiangxi Nailuo Copper Industry stated: "In the silver-copper tube market, achieving 90% excellence may not ensure survival—99% excellence is necessary for profitability."This "quality-focused strategy" is the core logic for niche markets to compete against mass production

Product Category

Content

- Demand Differentiation: High-End Applications Driving Growth in a Niche Market

- Technical Barriers: The Process Revolution Behind 0.1% Silver Content

- Regional Landscape: Europe Dominates the High End, China Breaks into Segments

- Future Trends: New Material Revolution and Substitution Challenges

- The Survival Strategy of a Niche Market

Related news

-

What is a thick-walled copper tube? Thick-walled copper tube, also known as seamless thick-walled copper tube, is a high-performance metal tube made o...

See Details -

Overview and Importance of Copper Capillary Tube In modern industrial equipment and precision control systems, miniaturization and high precision have...

See Details -

What is a copper tube? Analysis of material composition and basic characteristics Definition of copper tube Copper tube is a tubular object made of co...

See Details -

Understanding Copper Square Tubes: Composition, Grades, and Typical Applications Copper square tubes are specialized extrusions that combine the super...

See Details

English

English Español

Español 中文

中文