Is the Global Copper Tube Industry Shifting: Traditional Cooling vs. Green Tech Heating?

The global copper tube industry is currently experiencing significant shifts as it faces a period of unprecedented divergence. While traditional sectors, such as construction and HVAC (heating, ventilation, and air conditioning), are feeling the pressure from broader macroeconomic challenges, a surge in demand driven by green technology and advanced manufacturing is creating new growth opportunities.

This market bifurcation presents a critical inflection point for copper tube manufacturers. Companies are now forced to confront a pivotal strategic decision: continue competing in the highly competitive "red ocean" of established applications, or pivot towards the high-growth, technology-driven "blue oceans" in emerging sectors like renewable energy, electric vehicles (EVs), and sustainable manufacturing.

The shift towards these next-generation technologies is expected to reshape the copper tube landscape, offering manufacturers a chance to diversify into rapidly growing markets. Those who can adapt will not only weather the ongoing economic turbulence but could also position themselves as leaders in the sustainable energy and green technology revolutions.

A Deep Dive into Copper Tube Market Divergence: The "Cooling" and "Heating" Sectors

The global copper tube industry is undergoing a period of market bifurcation, where demand is increasingly driven by two distinct sectors: traditional applications and emerging high-tech industries. This shift presents both challenges and opportunities for copper tube manufacturers as they navigate these contrasting markets.

The "Cooling" Sector: Stagnation in Traditional Markets

Historically, the copper tube industry has been closely tied to the construction, HVAC (Heating, Ventilation, and Air Conditioning), and home appliance sectors. However, these traditional markets are currently facing significant headwinds.

HVAC Industry: Growth Slows in Building and Construction

The HVAC market remains the largest consumer of copper tubes, but demand is stagnating globally. High interest rates and a slowdown in the real estate market, particularly in China and Europe, have resulted in delayed projects and reduced demand for new HVAC systems. Copper tubes used in HVAC applications are largely standardized, which leads to intense price-based competition and squeezed margins. Manufacturers focused solely on this sector face ongoing challenges to profitability.

Home Appliance Manufacturing: Stable but Sluggish Demand

In the home appliance manufacturing sector, demand for copper tubes remains steady but unremarkable. While replacement cycles and incremental energy efficiency upgrades provide a baseline of demand, consumer spending volatility restricts significant growth. For copper tube suppliers, this sector is highly cost-sensitive, requiring operational excellence, lean production techniques, and strict cost control to remain competitive.

Strategic Focus for Copper Tube Suppliers in Traditional Markets

For manufacturers in these traditional sectors, the strategic focus must be on operational efficiency and cost control. This involves automating production lines, optimizing raw material usage, and implementing rigorous inventory management systems. To survive in this highly competitive market, companies must focus on survival and efficiency.

The "Heating" Sector: Explosive Demand from Green and High-Tech Industries

In contrast, demand for specialized copper tubes is surging in emerging industries, driven by global megatrends such as the energy transition, digitalization, and the rise of electric mobility. These sectors are poised for significant growth, creating lucrative opportunities for copper tube manufacturers.

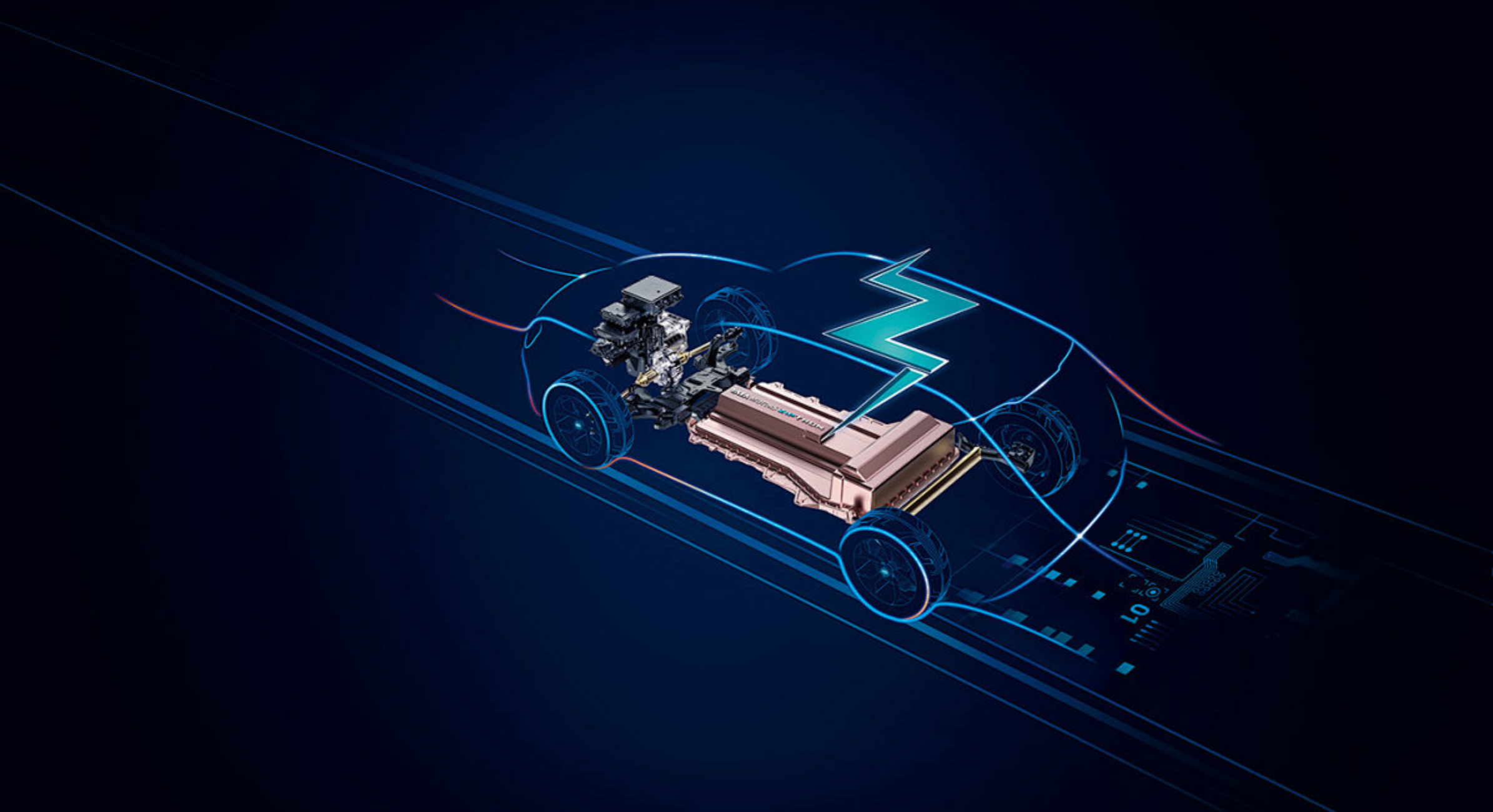

Electric Vehicles (EVs): Rising Demand for Thermal Management

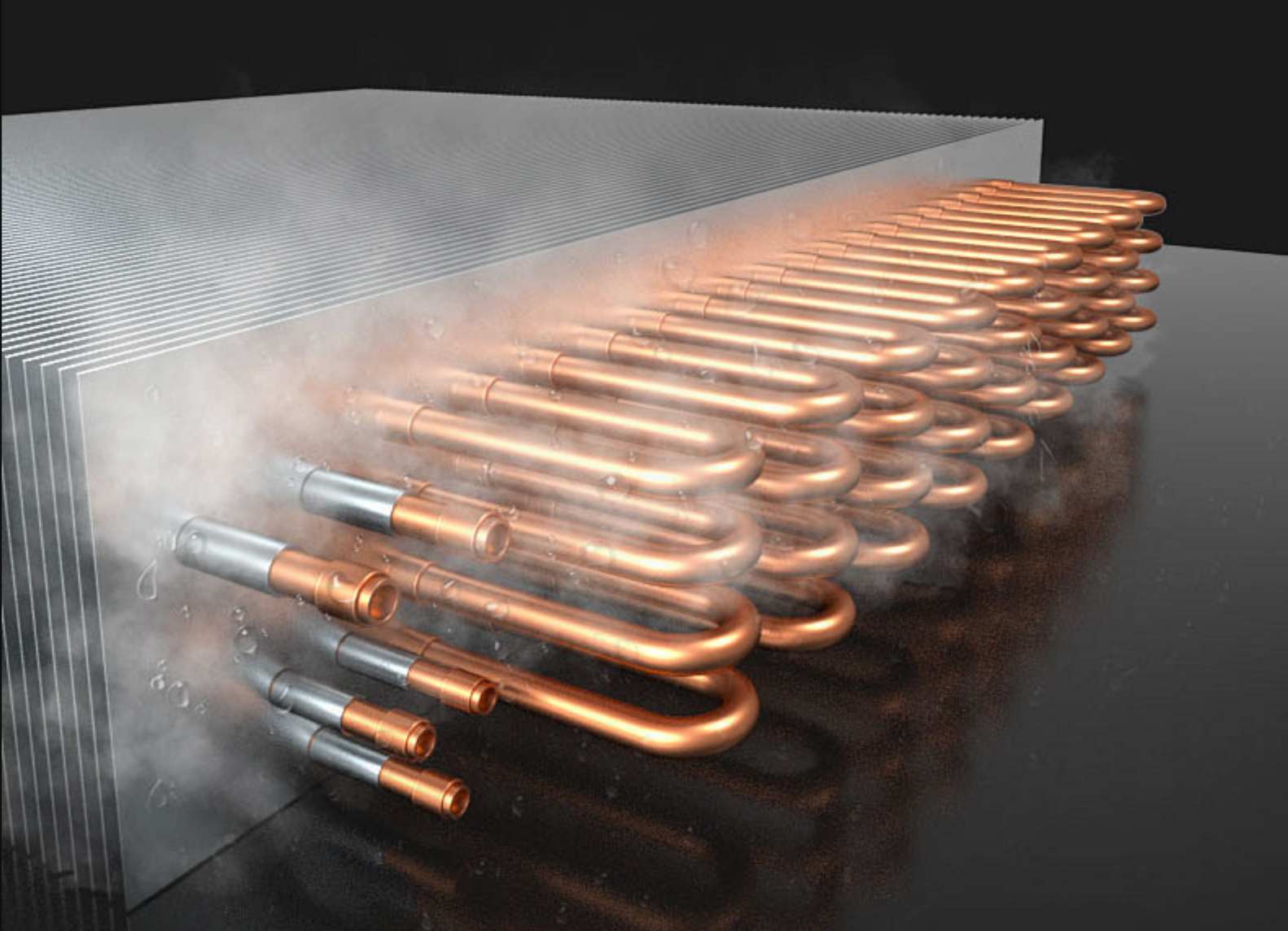

Copper tubes are essential in the thermal management systems of New Energy Vehicles (NEVs), playing a critical role in cooling battery systems, motors, and power electronics. As EVs require high-performance copper tubes for superior thermal conductivity and corrosion resistance, manufacturers are seeing increasing demand for micro-channel copper tubes. These tubes are lightweight, offer large surface areas for heat exchange, and are key to ensuring optimal performance in EVs. Manufacturers with the R&D capabilities to produce such advanced components are operating in a high-margin, high-growth environment.

Solar Power and Energy Storage: A Growing Market for Copper Tubes

The global shift towards renewable energy is fueling demand for copper tubes in photovoltaic (PV) systems and energy storage solutions (ESS). Copper tubes are essential for heat exchange in power conversion systems and the temperature regulation of battery storage units. These applications require copper tubes to withstand harsh environmental conditions and maintain long-term reliability. Manufacturers need specialized expertise and quality certifications to compete in these high-demand, high-tech markets.

Data Centers: Precision Copper Tubes for Cooling

As data centers expand to support rising demand for AI and cloud computing, liquid cooling systems are replacing traditional air cooling. Precision copper tubes are critical in direct-to-chip and immersion cooling solutions, which are essential for high-density servers. The growing demand for efficient cooling in digital infrastructures presents significant opportunities for manufacturers of high-value copper tubes.

Strategic Focus for Suppliers in High-Tech Markets

Copper tube manufacturers targeting high-tech applications must focus on innovation and specialization. Key to success in these markets is early-stage collaboration with clients, investing in advanced metallurgy, and mastering precision manufacturing techniques. To thrive in these rapidly growing sectors, the focus must be on growth and value creation.

The table below provides a detailed comparison of these contrasting demand dynamics:

|

Application Sector |

Demand Outlook |

Key Drivers |

Product & Capability Requirements |

Impact on Copper Tube Manufacturer |

|

Building HVAC |

Sluggish/Flat |

Real Estate Market, Interest Rates |

Standardized, Cost-Sensitive, High Volume |

Price-based competition, margin pressure, focus on operational efficiency. |

|

Home Appliances |

Stable |

Consumer Spending, Efficiency Standards |

Cost-Effectiveness, Consistency |

Requires lean manufacturing and supply chain optimization. |

|

New Energy Vehicles (NEVs) |

Very Strong (20%+ CAGR) |

Global EV Adoption, Battery Performance Needs |

Lightweight, Thin-Walled, High-Purity, Complex Geometries (Micro-channel) |

Demands high R&D investment, technical collaboration, and premium pricing. |

|

PV & Energy Storage |

Very Strong |

Global Energy Transition, Government Policies |

High Corrosion Resistance, Long Lifespan (25+ years), Reliability |

Requires specialized alloys, rigorous testing, and certification processes. |

|

Data Center Cooling |

Strong (Rapid Adoption) |

AI/ML Boom, Cloud Computing, Power Density |

Precision Tubes, Custom Shapes, High Thermal Performance |

Necessitates engineering support and ability to handle low-volume, high-mix orders. |

The Manufacturer’s Dilemma: Strategic Choices for Copper Tube Producers

The copper tube industry is at a critical crossroads, with manufacturers facing a strategic dilemma that will determine their future growth trajectory. With the market split between traditional applications and emerging high-tech industries, each copper tube producer must carefully choose their path.

Path A: The Traditionalist – Mastering Efficiency in a Mature Market

For copper tube manufacturers deeply embedded in traditional supply chains, the focus remains on cost leadership. These manufacturers prioritize efficiency to remain competitive in a mature, price-sensitive market. Their strategy includes:

- Process Automation: Investing in advanced drawing, annealing, and finishing lines to minimize human labor and reduce unit labor costs, driving overall operational efficiency.

- Supply Chain Optimization: Securing long-term contracts for cathode copper, implementing just-in-time inventory systems, and managing working capital to maximize cost savings.

- Product Standardization: Limiting R&D investment by focusing on high-volume, standardized copper tube sizes that cater to traditional markets like HVAC and appliance manufacturing.

This strategy works for large-scale producers with established market shares, but it’s heavily reliant on volume-based sales. The downside is that such a model leaves manufacturers vulnerable to economic downturns, fluctuations in copper prices, and tightening margins due to fierce competition.

Path B: The Innovator – Pivoting to Value-Added and Specialized Products

The second path represents a fundamental shift towards innovation and value-added products, where copper tube manufacturers evolve from simple component suppliers to critical solutions partners. Manufacturers adopting this path will focus on:

- Advanced R&D Capabilities: Establishing research and development centers to innovate new alloys with specialized properties, such as anti-corrosion alloys for energy storage systems (ESS) or ultra-thin-walled copper tubes for electric vehicle (EV) heat exchangers.

- Application Engineering Teams: Building teams of engineers to work directly with OEMs (Original Equipment Manufacturers), co-designing thermal management systems and embedding customized copper tubes as essential components early in the product development process.

- Specialized Manufacturing Capabilities: Investing in niche manufacturing technologies to produce non-standard shapes, micro-channel copper tubes, and other specialized products tailored to emerging markets like renewable energy, solar power, and data center cooling.

This strategy requires a significant upfront investment and a cultural shift toward innovation and specialization. However, it offers higher margins, more stable customer relationships, and protection from the volatility of commodity cycles.

Strategic Insights for Copper Tube Manufacturers

Manufacturers who pursue the Traditionalist path are likely to face long-term pressure as markets become more commoditized. In contrast, those who embrace the Innovator strategy stand to benefit from the rising demand for high-tech applications such as electric vehicles, renewable energy systems, and data centers, offering opportunities for higher growth, stability, and profitability.

Case Study: How a Leading Copper Tube Manufacturer is Adapting to Industry Shifts

To understand how copper tube manufacturers are navigating market changes, let’s explore the strategy of a global leader in the industry: Sigma Copper Tubes. Historically dominant in the HVAC sector, Sigma recognized early the need to adapt to the rapidly evolving market landscape.

"Five years ago, we saw the writing on the wall," said Dr. Lisa Wang, Chief Technology Officer at Sigma. "We knew that to stay relevant, our copper tube portfolio had to evolve. We made a conscious decision to divert a significant portion of our profits from traditional lines into R&D for high-growth sectors."

Sigma's transformation journey involved several key strategic moves:

Acquisition of Specialized Technology

Sigma acquired a specialized copper tube manufacturer known for its expertise in precision tubes used in the aerospace industry. This acquisition not only provided advanced technology but also brought in critical talent, strengthening Sigma's R&D capabilities in high-performance, precision copper tubes.

Internal Investment in High-Tech Manufacturing

Sigma invested in a new, dedicated production line for micro-channel copper tubes, specifically designed for the growing electric vehicle (EV) market. These tubes are critical components in the thermal management systems of EVs, offering superior heat exchange properties crucial for battery cooling and motor temperature regulation.

Strategic Partnerships for Thermal Management

To further innovate, Sigma formed strategic joint ventures with coolant producers and battery manufacturers, developing integrated thermal system solutions for the EV and renewable energy sectors. This collaboration allowed Sigma to create customized thermal management systems, positioning them as a critical player in EV cooling technology.

"The copper tube is no longer just a pipe," Dr. Wang added. "In an EV, it's an active, performance-critical component. We're not just selling a material; we're selling thermal efficiency, range extension, and safety. This changes everything about how we operate as a copper tube manufacturer."

Sigma’s strategic shift to focus on high-tech applications such as EV thermal systems and renewable energy demonstrates how the copper tube industry is evolving beyond traditional markets. By embracing innovation and forming partnerships, Sigma has positioned itself as a leader in the next-generation applications of copper tubes.

The Raw Material Challenge: Navigating Volatile Copper Prices in the Copper Tube Industry

A significant challenge underpinning the strategic shifts in the copper tube industry is the ongoing volatility of copper prices. As the primary raw material in copper tube production, copper can account for 70-80% of the total cost of a finished copper tube. This volatility affects all copper tube manufacturers, though in different ways depending on their market focus.

For the Traditionalist: Copper Price Swings as a Survival Challenge

For traditional copper tube manufacturers entrenched in high-volume, low-margin markets, price fluctuations in copper represent a direct threat to profitability and survival. These manufacturers often struggle to pass on cost increases due to intense competition and the standardization of their products. To mitigate the impact of price volatility, these companies must be highly skilled in hedging strategies and supply chain management. Effective inventory management and long-term supplier contracts are crucial to smooth out margins and maintain operational stability in the face of fluctuating raw material costs.

For the Innovator: Navigating Copper Price Volatility with High-Value Products

For innovative copper tube manufacturers focused on high-performance, value-added products, the impact of copper price volatility is somewhat buffered by the higher value of their specialized offerings. These manufacturers often incorporate pricing clauses into contracts that allow them to share the raw material cost risks with their customers. In many cases, the value-added nature of their micro-channel copper tubes, precision tubes, or other specialized products is large enough to absorb some of the price volatility. This allows them to maintain profitability even as copper prices fluctuate.

The Circular Economy: A Sustainable Solution for Copper Tube Producers

Beyond price volatility, there is increasing pressure for the copper tube industry to embrace a circular economy approach. Leading copper tube manufacturers are increasingly incorporating recycled copper into their production processes. This not only helps mitigate the financial impact of raw material price swings but also aligns with growing sustainability goals. By using recycled copper, manufacturers can reduce their environmental footprint and meet the sustainability targets of customers, particularly those in the green technology sector.

Incorporating recycled copper into production processes also provides an opportunity for manufacturers to reduce their dependency on raw material prices and create more stable, sustainable supply chains.

Future Outlook: The Green Transition as the North Star for Copper Tube Manufacturers

The future of the copper tube industry is becoming increasingly clear: the trajectory of growth is directly tied to the global energy transition and the rapid rise of green technologies. While traditional markets, particularly construction, will continue to represent a significant portion of the copper tube demand, the future growth—and more importantly, the profitability—will be driven by high-tech and sustainable applications.

"The industry is at a strategic juncture," said Michael Brown, Senior Metals Analyst at Roe & Partners. "The decade ahead will be defined by specialization. The successful copper tube manufacturer of 2030 will likely be a focused player, known for expertise in specific niches like EV cooling or data center liquid cooling, rather than a general-purpose supplier. Short-term pains from the real estate sector are inevitable, but in the long run, companies that align with the waves of energy revolution and technological innovation will be best positioned to navigate the cycle and secure their future."

The End of One-Size-Fits-All Copper Tube Production

The message from industry analysts is clear: the era of generic copper tube production is ending. Going forward, copper tube manufacturers will need to embrace agility, innovation, and specialization. The market will demand more than just basic copper tubes; it will demand customized, high-performance solutions for sectors like electric vehicles (EVs), data center cooling, and renewable energy systems.

For manufacturers, this means that diversification into green technologies and high-tech applications will be key to staying competitive. Whether it’s providing advanced micro-channel copper tubes for EV thermal management, creating precision tubes for data center cooling, or supporting the energy transition through sustainable copper production, specialization will be the defining factor for success.

Specialization and Innovation: The Path to Long-Term Profitability

As the global demand for sustainable energy solutions continues to rise, the copper tube industry must adapt. Manufacturers who can deliver high-value, specialized products for the green energy sector, electric vehicle market, and advanced manufacturing applications will be best positioned to capitalize on long-term growth opportunities.

The future of copper tube production will not be about mass-market, low-margin products; it will be about offering solutions that are tightly aligned with technological advancements and sustainability trends. Manufacturers who invest in innovation, research and development, and niche expertise will not only thrive but help shape the next generation of copper tube applications.

Product Category

Content

- A Deep Dive into Copper Tube Market Divergence: The "Cooling" and "Heating" Sectors

- The Manufacturer’s Dilemma: Strategic Choices for Copper Tube Producers

- Case Study: How a Leading Copper Tube Manufacturer is Adapting to Industry Shifts

- The Raw Material Challenge: Navigating Volatile Copper Prices in the Copper Tube Industry

- Future Outlook: The Green Transition as the North Star for Copper Tube Manufacturers

Related news

-

What is a thick-walled copper tube? Thick-walled copper tube, also known as seamless thick-walled copper tube, is a high-performance metal tube made o...

See Details -

Overview and Importance of Copper Capillary Tube In modern industrial equipment and precision control systems, miniaturization and high precision have...

See Details -

What is a copper tube? Analysis of material composition and basic characteristics Definition of copper tube Copper tube is a tubular object made of co...

See Details -

Understanding Copper Square Tubes: Composition, Grades, and Typical Applications Copper square tubes are specialized extrusions that combine the super...

See Details

English

English Español

Español 中文

中文